Stock options granted to contractors

Tax errors can be costly! Don't draw unwanted attention from the IRS.

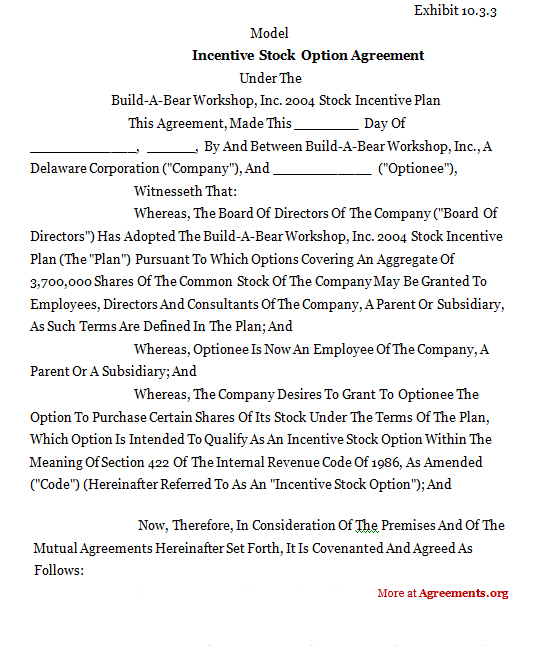

“So You Accidentally Granted Incentive Stock Options To An Independent Contractor…” | First Venture Legal

Our Tax Center explains and illustrates the tax rules for sales of company stock, W-2s, withholding, estimated taxes, AMT, and more. Private companies sometimes partly use stock options NQSOs, not ISOs or stock grants, along with or instead of cash, to compensate consultants and independent contractors separate from grants that public and private companies make to nonemployee directors.

The size and terms of these grants can be different from those made to employees and should be considered in your negotiations see a related FAQ.

If the company goes public or is acquired, these options may become highly valuable. If the IPO or merger never happens, the options could be worthless. Depending on the economy, local market conditions, and attitudes toward stock options, these grants are also made to lawyers, landlords, advertisers, recruiters, and other nonemployee service providers as well as important customers.

Grants of stock options are unlikely to be taxable to you until exercise see related FAQs on the taxation and reporting for stock options and for restricted stock to consultants and contractors.

However, an outright stock grant is compensation income that is taxable on its value at grant unless it first must vest i.

Restricted stock is taxed on the value at vesting unless you file a timely Section 83 b election to be taxed on the value at grant.

Need a financial, tax, or legal advisor?

Search AdvisorFind from myStockOptions. How common is this practice? Taxes Grants of stock options are unlikely to be taxable to you until exercise see related FAQs on the taxation and reporting for stock options and for restricted stock to consultants and contractors.

When you receive an outright vested stock grant in exchange for your services legal, marketing, etc. Not receiving a MISC from the company does not mean you can avoid reporting income.

Frank Denneman

Even though you cannot easily resell the shares because they are not registered with the SEC and your state, the stock is taxable income for an amount equal to its fair market value. You will need a reasonable valuation from an expert or the company. Home My Records My Tools My Library.

Can consultants or independent contractors be granted stock options or company stock? How common is this practice? - ywepubuy.web.fc2.com

Tax Center Global Tax Guide Discussion Forum Glossary. About Us Corporate Customization Licensing Sponsorships. Newsletter User Agreement Privacy Sitemap.

The content is provided as an educational resource. Please do not copy or excerpt this information without the express permission of myStockOptions. Can consultants or independent contractors be granted stock options or company stock? Next FAQ in list.