Convertible debt put option

What is an option? definition and meaning - ywepubuy.web.fc2.com

In finance , a convertible bond or convertible note or convertible debt or a convertible debenture if it has a maturity of greater than 10 years is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features.

What are the benefits of debt in a seed round? - Venture Hacks

To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments and the return of principal upon maturity. These properties lead naturally to the idea of convertible arbitrage , where a long position in the convertible bond is balanced by a short position in the underlying equity.

From the issuer's perspective, the key benefit of raising money by selling convertible bonds is a reduced cash interest payment.

Premium Put Convertible Bond Definition & Example | Investing Answers

The advantage for companies of issuing convertible bonds is that, if the bonds are converted to stocks, companies' debt vanishes. However, in exchange for the benefit of reduced interest payments, the value of shareholder's equity is reduced due to the stock dilution expected when bondholders convert their bonds into new shares. Underwriters have been quite innovative and provided several variations of the initial convertible structure.

Convertible BondsAlthough no clear classification formally exists in the financial market it is possible to segment the convertible universe into the following sub-types:. Any convertible bond structure, on top of its type, would bear a certain range of additional features as defined in its issuance prospectus:. Due to their relative complexity, convertible bond investors could refer to the following terms while describing convertible bonds:. The global convertible bond market is relatively small, with about bn USD as of Jan , excluding synthetics , as a comparison the straight corporate bond market would be about 14, bn USD.

Among those bn, about bn USD are "Vanilla" convertible bonds, the largest sub-segment of the asset class. Convertibles are not spread equally and some slight differences exist between the different regional markets:.

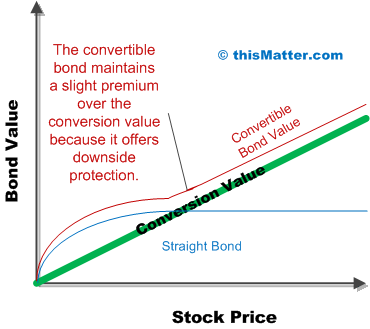

The splits between those investors differ across the regions: Globally the split is about balanced between the two categories. In theory, the market price of a convertible debenture should never drop below its intrinsic value. The intrinsic value is simply the number of shares being converted at par value times the current market price of common shares.

From a valuation perspective, a convertible bond consists of two assets: Valuing a convertible requires an assumption of. Using the market price of the convertible, one can determine the implied volatility using the assumed spread or implied spread using the assumed volatility.

What makes convertibles so interesting is that, except in the case of exchangeables see above , one cannot entirely separate the volatility from the credit. Higher volatility a good thing tends to accompany weaker credit bad.

In the case of exchangeables, the credit quality of the issuer may be decoupled from the volatility of the underlying shares. The true artists of convertibles and exchangeables are the people who know how to play this balancing act.

A simple method for calculating the value of a convertible involves calculating the present value of future interest and principal payments at the cost of debt and adds the present value of the warrant. However, this method ignores certain market realities including stochastic interest rates and credit spreads, and does not take into account popular convertible features such as issuer calls, investor puts, and conversion rate resets.

The most popular models for valuing convertibles with these features are finite difference models as well as the more common binomial- and trinomial trees.

Since , most market-makers in Europe have employed binomial models to evaluate convertibles. Models were available from INSEAD , Trend Data of Canada, Bloomberg LP and from home-developed models, amongst others.

These models needed an input of credit spread, volatility for pricing historic volatility often used , and the risk-free rate of return. The binomial calculation assumes there is a bell-shaped probability distribution to future share prices, and the higher the volatility, the flatter is the bell-shape.

Where there are issuer calls and investor puts, these will affect the expected residual period of optionality, at different share price levels. The binomial value is a weighted expected value, 1 taking readings from all the different nodes of a lattice expanding out from current prices and 2 taking account of varying periods of expected residual optionality at different share price levels.

See Lattice model finance Hybrid Securities. The three biggest areas of subjectivity are 1 the rate of volatility used, for volatility is not constant, and 2 whether or not to incorporate into the model a cost of stock borrow, for hedge funds and market-makers. The third important factor is 3 the dividend status of the equity delivered, if the bond is called, as the issuer may time the calling of the bond to minimise the dividend cost to the issuer.

From Wikipedia, the free encyclopedia. Derivatives Credit derivative Futures exchange Hybrid security. Foreign exchange Currency Exchange rate.

Premium Put Convertible

Bond Debenture Fixed income. Agency bond Corporate bond Senior debt Subordinated debt Distressed debt Emerging market debt Government bond Municipal bond.

Accrual bond Auction rate security Callable bond Commercial paper Contingent convertible bond Convertible bond Exchangeable bond Extendible bond Fixed rate bond Floating rate note High-yield debt Inflation-indexed bond Inverse floating rate note Perpetual bond Puttable bond Reverse convertible securities Zero-coupon bond. Clean price Convexity Coupon Credit spread Current yield Dirty price Duration I-spread Mortgage yield Nominal yield Option-adjusted spread Risk-free bond Weighted-average life Yield curve Yield spread Yield to maturity Z-spread.

Asset-backed security Collateralized debt obligation Collateralized mortgage obligation Commercial mortgage-backed security Mortgage-backed security.

Callable bond Convertible bond Embedded option Exchangeable bond Extendible bond Puttable bond. Commercial Mortgage Securities Association CMSA International Capital Market Association ICMA Securities Industry and Financial Markets Association SIFMA. Corporate finance and investment banking. Convertible debt Exchangeable debt Mezzanine debt Pari passu Preferred equity Second lien debt Senior debt Senior secured debt Shareholder loan Stock Subordinated debt Warrant.

At-the-market offering Book building Bookrunner Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting.

Buy side Control premium Demerger Divestment Drag-along right Management due diligence Managerial entrenchment Minority discount Pitch book Pre-emption right Proxy fight Post-merger integration Sell side Shareholder rights plan Special situation Squeeze out Staggered board of directors Stock swap Super-majority amendment Tag-along right Takeover Reverse Tender offer.

Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. List of investment banks Outline of finance. Retrieved from " https: Bonds finance Commercial bonds Corporate finance.

Articles needing additional references from August All articles needing additional references. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store.

Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 7 May , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.

Bond valuation Corporate bond Fixed income Government bond High-yield debt Municipal bond Securitization. Common stock Preferred stock Registered share Stock Stock certificate Stock exchange.

Derivatives Credit derivative Futures exchange Hybrid security Foreign exchange Currency Exchange rate Commodity Money Real estate Reinsurance. Forwards Options Spot market Swaps. Participants Regulation Clearing house. Banks and banking Finance corporate personal public. This article needs additional or better citations for verification. Please help improve this article by adding citations to reliable sources.

Unsourced material may be challenged and removed. August Learn how and when to remove this template message.

Equity offerings At-the-market offering Book building Bookrunner Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting.