Volume analysis forex

Ghous Technical Analysis , Tips 1 Comment 2, Views. Real volume — as used in other markets like stocks — is, of course, the number of units of the trading instrument actually traded in a given time period.

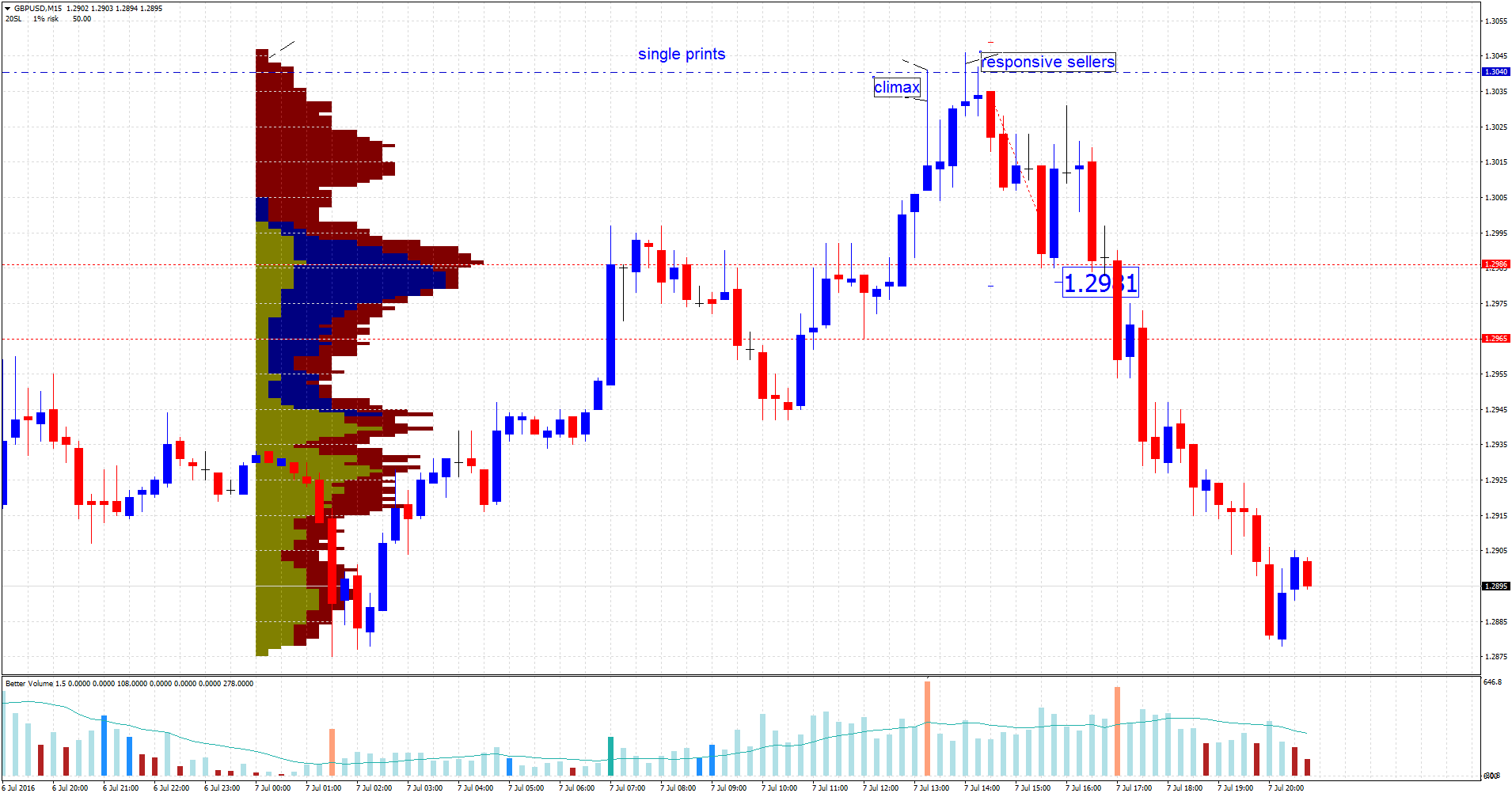

Hence tick volumes need to be used as proxy for real volumes. The underlying logic is that with increased order flow , price should generally move more ticks, therefore, printing a larger tick volume bar on your free meta trader platform. What these tools essentially show is only a tiny glimpse of an already minuscule and non-authoritative segment of retail trading in Forex.

But before you decide to dump away your Volume indicators, I do have some good news. Volumes in Forex do work! Thinking about it, tick volumes may not be giving us real-time order flow cues, but they are giving us a fair idea about how rapidly price is moving in a particular direction more rapid price movement equals higher tick volumes.

As a price action trader, this bit of information can be gold when put in tandem with other relevant information. While I am a believer in using tick volume in Forex, I do not believe in applying full blown volume-based trading strategies such as volume spread analysis VSA that is used often in centralized markets with known real volumes.

The Secret to Accurate Volume Analysis in Day Trading RelativeIndicators Suite from Trade The PlanWith Forex it is important to understand that tick volumes are still just a proxy for real volumes and your competitive edge in the market cannot be built upon proxy indicators for true momentum. I like to use tick volumes in Forex as a secondary validation for strength or lack thereof of the market. And as you will see in a bit, it can lend important clues in developing an overall understanding of the direction that price is trading in. It is reasonable to assume that if price is trading in the right direction, traders should have a keen interest in pushing their order buttons, hence propelling order flow as well as tick volume price should move more rapidly covering a higher tick count.

3 Ways to Improve a Strategy Using Real Trading Volume

On the contrary, if price is trading in the opposite direction such as pulling back while in a strong uptrend the move should be associated with lower trading volumes: Staying within the context of what I just said, how exactly should a true breakout from a vivid chart pattern look via tick volumes? If you said big volume bars indicating strong momentum, you are right!

Would you be worried about a possible fake breakout if volume bars did not print higher at a breakout point? You can see pairing tick volume information with other powerful bits of price action information like horizontal support and resistance levels can help expand your understanding of why the market is moving the way it is.

I would caution against using tick volume information as the sole trigger to a trade, but when equipped with other aspects, it can serve as a killer filtering tool helping you choose the best of the best trades. Your email address will not be published. Trading Resources Tradeciety Academy About us Contact Webmasters.

Tradeciety — Trading tips, technical analysis, free trading tools Forex Trading Blog And Trading Academy. Trading Blog Technical Analysis Market Analysis Indicators Price Action Psychology Beginners Risk Management Statistics Tips Premium Courses Member Login My Courses Member Forum Become A Member. Using Volume in Forex While I am a believer in using tick volume in Forex, I do not believe in applying full blown volume-based trading strategies such as volume spread analysis VSA that is used often in centralized markets with known real volumes.

Basic Cues It is reasonable to assume that if price is trading in the right direction, traders should have a keen interest in pushing their order buttons, hence propelling order flow as well as tick volume price should move more rapidly covering a higher tick count. Forex Trading Academy Forex price action course Private forum Weekly setups Apply Here. Tiana April 25, at 9: Leave a Reply Cancel reply Your email address will not be published.

We are Rolf and Moritz.

Volume Spread Analysis Trading Method - Forex Strategies - Forex Resources - Forex Trading-free forex trading signals and FX Forecast

We have a passion for trading and sharing our knowledge. We travel the world and hope to inspire.

We quit our corporate jobs a few years ago and are now living life the way we want it to be. Our holy grail is hard work and independence. We have a passion for sharing our knowledge of the markets and hope to help other traders improve their trading.

Tradeciety Trading Courses About Us Contact us Free Beginner Courses. Trading Futures, Forex, CFDs and Stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results. Articles and content on this website are for entertainment purposes only and do not constitute investment recommendations or advice.

Full Terms Image Credit: Tradeciety used images and image licenses downloaded and obtained through Fotolia , Flaticon , Freepik and Unplash. Trading charts have been obtained using Tradingview , Stockcharts and FXCM. Icon design by Icons8.

4 Simple Volume Trading Strategies - Tradingsim

Imprint Privacy Policy Risk Disclaimer Terms. Enter your email and get instant access. Please share to spread the word Facebook Twitter Email. We use cookies to ensure that we give you the best experience on our website. The continuous use of this site shows your agreement. Privacy Policy I accept.