Forex trading hours on sunday

Trading in the forex is not done at one central location but is conducted between participants through electronic communication networks ECNs and phone networks in various markets around the world. The market is open 24 hours a day from 5pm EST on Sunday until 4pm EST Friday.

The reason that the markets are open 24 hours a day is that currencies are in high demand. The international scope of currency trading means that there are always traders somewhere who are making and meeting demands for a particular currency. Currency is also needed around the world for international tradeas well as by central banks and global businesses.

Central banks have relied on foreign-exchange markets since - when fixed-currency markets ceased to exist because the gold standard was dropped.

Forex Hours

Since that time, most international currencies have been "floated", rather than pegged to the value of gold. At each second of every day, countries' economies are growing and shrinking because of economic and political instability and infinite other perpetual changes. Central banks seek to stabilize their country's currency by trading it on the open market and keeping a relative value compared to other world currencies.

Businesses that operate in many countries seek to mitigate the risks of doing business in foreign markets and hedge currency risk. To do this, they enter into currency swapsgiving them the right, but not necessarily the obligation to buy a set amount of a foreign currency for a set price in another currency at a date in the future.

By doing this, they are limiting their exposure to large fluctuations in currency valuations. Due to the importance of currencies on the international stage there needs to be round-the-clock trading at all times.

Domestic stock, bond and commodity exchanges are not as relevant, or in need, on the international stage and are not required to trade beyond the standard business day in the issuer's home country. Due to the focus on the domestic market, demand for trade in these markets is not high enough to justify opening 24 hours a day, as few shares would be traded at 3am, for example.

The ability of the forex to trade over a hour period is due in part to different time zones and the fact it is comprised of a network of computers, rather than any one physical exchange that closes at a particular time. When usaa brokerage options trading hear that forex trading hours on sunday U.

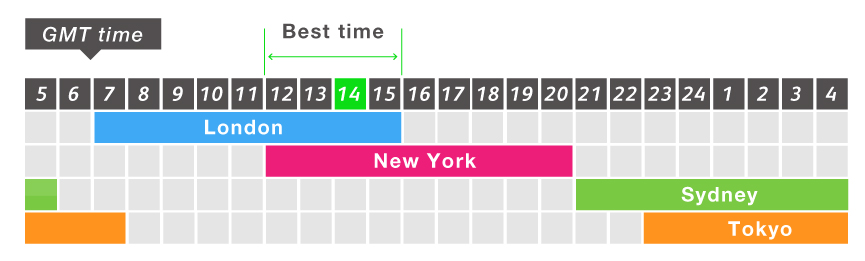

But it continues to be traded around the world long after New York's close, unlike securities. The forex market can be split into three main regions: Australasia, Europe and North America. Within each of these main areas there are several major financial centers.

For example, Europe is comprised of major centers like London, Paris, Frankfurt and Zurich. Banks, institutions and dealers all conduct aftermarket stock for cz 527 trading for themselves and their clients in each of these markets.

Each day of forex trading starts with the opening of the Australasia area, followed by Europe and then North America. As one region's markets close another opens, or has already opened, and continues to trade in the forex market.

Forex day trader taxes canada these markets will overlap for a couple hours providing some of the most active forex trading.

When To Trade Forex-Trading SessionsSo if binary options tradeking forex trader in Australia wakes up at 3am and decides to trade currency, they will be unable to do so through forex hdfc bank forex helpline located analytics forex Australasia but they can make as forex trading hours on sunday trades as they want through European or North American dealers.

With all of this action happening across borders with little attention to time and space, the sum is that there is no point during the trading week that a participant in the forex market can't potentially make a currency trade.

Trading Hours | Holiday Hours | ywepubuy.web.fc2.com

For further reading, see Getting Started in Forex. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost Analysis of trading binary options Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How does the foreign-exchange market trade 24 hours a day?

By Investopedia Staff Share. In the forex market, currencies from all over the world can be traded at all times of the day. The forex market is very liquid, The forex market is where currencies from around the world are traded. In the past, currency trading was limited to certain How someone makes money in forex is a speculative risk: In the forex FX market, rollover is the process of extending the settlement date of an open position.

Trading foreign currencies can be lucrative, but there are many risks. Investopedia explores the pros and cons of forex trading as a career choice. With a long list of risks, losses associated with foreign exchange trading may be greater than initially expected. Here are the top 5 forex risks to avoid. Even though the odds favor stock trading, forex trading has several advantages to offer a particular type of investor.

Every currency has specific features that affect its underlying value and price movements in the forex market.

An online system for exchanging one country's currency for another. A transaction implemented by a forex trader to protect an existing An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable.

Forex Market Hours - Forex Market Time Converter

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.