Bill clinton stock market

We are going to reveal the grand secret to getting rich by investing.

Economic Record: President Clinton

It's a simple formula that has worked for Warren Buffett, Carl Icahn and all the greatest investment gurus over the years. It turns out that Donald Trump has been very, very good at buying low and selling high, and it helps account for his amazin business success. But now Hillary Clinton seems to think it's a crime.

Campaigning in California last week she complained that Trump "actually said he was hoping for the crash that caused hard working families in California and across America to lose their homes, all because he thought he could take advantage of it to make some money for himself.

CHINA: SHANGHAI: US PRESIDENT CLINTON VISIT UPDATEHillary's new TV ads say that Trump predicted the real estate crash in good call and then bought real estate at low prices when the housing crash came in that few others foresaw. Many builders went out of business during the crash, but Trump read the market perfectly.

What is so hypocritical about the Clinton attacks is that it wasn't Trump, but Hillary, her husband, and many of her biggest supporters who were the real culprits here.

Bill Clinton - 25 People to Blame for the Financial Crisis - TIME

Before Hillary is able to rewrite this history, let's look at the many ways the Clintons and cronies contributed to the Great Recession. Under Clinton's Housing and Urban Development HUD secretary, Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in "credit-deprived" areas.

Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.

Economic policy of the Bill Clinton administration - Wikipedia

If banks didn't comply with these rules, regulators reined in their ability to expand lending and deposits. These new HUD rules lowered down payments from the traditional 20 percent to 3 percent by and zero down-payments by What's more, in the Clinton push to issue home loans to lower income borrowers, Fannie Mae and Freddie Mac made a common practice to virtually end credit documentation, low credit scores were disregarded, and income and job history was also thrown aside.

The phrase "subprime" became commonplace. Next, the Clinton administration's rules ordered the taxpayer-backed Fannie and Freddie to expand their quotas of risky loans from 30 percent of portfolio to 50 percent as part of a big push to expand home ownership.

Fannie and Freddie were securitizing these home loans and offering percent taxpayer guarantees of repayment. So now taxpayers were on the hook for these risky, low down-payment loans. Tragically, when prices fell, lower-income folks who really could not afford these mortgages under normal credit standards, suffered massive foreclosures and personal bankruptcies.

So many will never get credit again. It's a perfect example of liberals using government allegedly to help the poor, but the ultimate consequences were disastrous for them.

Additionally, ultra-easy money from the Fed also played a key role. Rates were held too low for too long in , which created asset price bubbles in housing, commodities, gold, oil, and elsewhere. When the Fed finally tightened, prices collapsed.

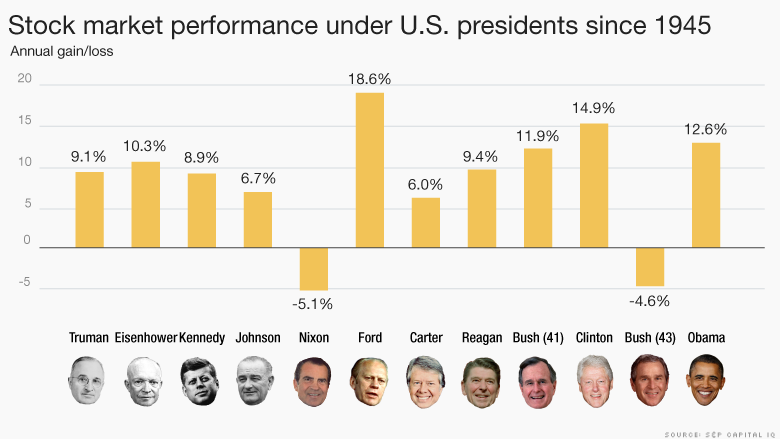

Would President Hillary Clinton be good for the stock market? - Feb. 16,

So did mortgage collateral homes and mortgage bonds that depended on the collateral. Many bond packages were written to please Fannie and Freddie, based on the fantastical idea that home prices would never fall. Just to make this story worse, Senator Hillary Clinton and Senator Barack Obama voted to filibuster a Republican effort to roll back Fannie and Freddie. But on top of all this, while Hillary was propping up Fannie and Freddie, she was taking contributions from their foundations.

To be clear, there was plenty of blame to go around among both political parties and the horde of housing lobbyists who helped set up this real estate house of cards.

It's a sordid story with plenty of blame all around. It now includes profit sweeping from shareholders to the government, thereby ending any chance to sell the mortgage agencies back to the private sector.

Meanwhile, Hillary's attempt to blame Donald Trump is utterly absurd. Buying low and selling high is not against the law. Trump's investment acumen may serve America well in the not too distant future.

Commentary by Larry Kudlow, a senior contributor at CNBC and economics editor of the National Review. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Make It Entrepreneurs Leadership Careers Money Specials Shows Video Top Video Latest Video U.

Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes Shows Watch Live CNBC U.

Business Day CNBC U. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Full Episodes. Log In Register Log Out News Economy Finance Health Care Real Estate Wealth Autos Consumer Earnings Energy Life Media Politics Retail Commentary Special Reports Asia Europe CFO Council.

Asia Europe Stocks Commodities Currencies Bonds Funds ETFs. Make It Entrepreneurs Leadership Careers Money Specials Shows Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener.

Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Special Reports Top States Paris Airshow Trailblazers Trading the World CNBC Disruptor 50 Lasting Legacy Modern Medicine College Game Plan Investing in: Israel Tech Drivers The Brave Ones Trading Nation Shaping the future Future Opportunities. Register Log In Profile Email Preferences PRO Sign Out.

Are the Clintons the real housing crash villains? Lawrence Kudlow and Stephen Moore, chief economist at the Heritage Foundation. Buy low, sell high. The real reason foreclosures spiked in October. The seeds of the mortgage meltdown were planted during Bill Clinton's presidency.

Stephen Moore is chief economist at the Heritage Foundation.